In 2009 the Dutch organization PAX and Belgium organization Netwerk Vlaanderen (now FairFin) published the first research into investments in cluster munitions, working closely with the ICBL-CMC, in the joint campaign Stop Explosive Investments.

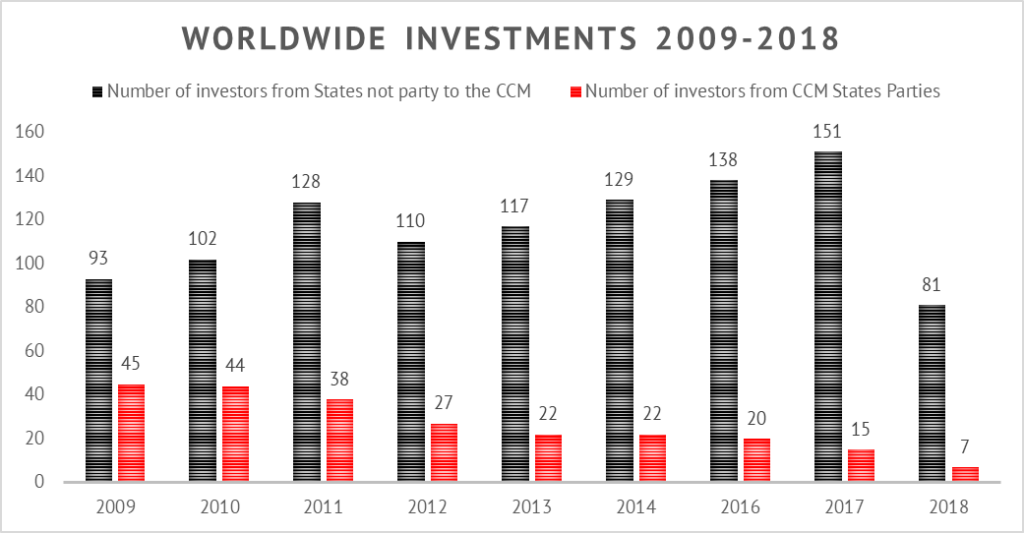

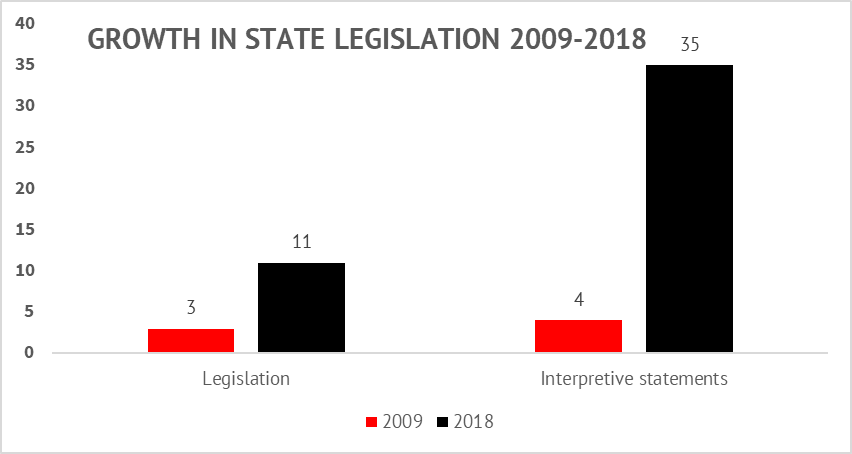

From 2009 – 2018 the Stop Explosive Investment campaign has delivered frequently updated research publications on financial investments in cluster munitions producers, highlighting good examples of financial institutions excluding investments on the one hand, and listing institutions worldwide that sustained investments in these producers on the other hand. The research also provided insight into different legislative initiatives of states to ban investments in cluster munitions. Worldwide actions have been implemented by civil society, to call upon their banks and financial institutions to seize these investments because of the unacceptable civilian harm these weapons cause. All annual research publications are available in the archive.

What did we do?

Throughout the years, the Stop Explosive Investments campaign took to the streets , organized media briefings , had countless meetings with banks, pension funds, and other financial institutions, engaged with parliamentarians, collected signatures and organized all other sorts of activities to raise awareness. It is clear, clients do not want their money to go into cluster munitions producers.

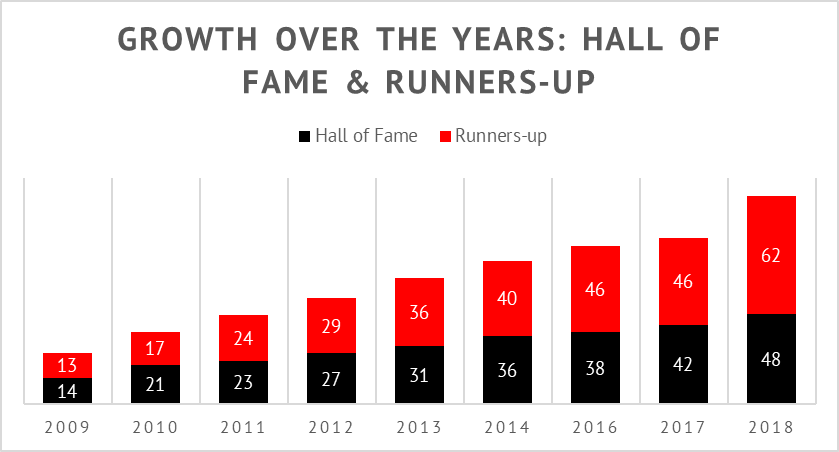

The campaign has delivered tangible results, and has increased awareness within the financial community about why and how to exclude these investments for good. The overall investments on our radar have decreased, the number of disinvestment policies for cluster munitions have gained extensively in quantity and quality over the years.

With what effect?

Since 2009, eight producers of cluster munitions have publicly announced

to stop the production of cluster munitions.

What is next?

All-comprehensive exclusion policies are the only way to sustainably ban investments in cluster munitions, and we commend all the financial institutions that have installed policies to this effect. The implementation of these policies now lies in their hands.

Financial institutions that have not yet done so, should install policies that prevent any money flowing to companies involved in the production of these inhumane weapons without delay.

Financial institutions should implement these policies and screen (themselves or through available screening companies) their investment portfolios, demanding guarantees from the companies they invest in to exclude any involvement in the development and production of cluster munitions.

States, following their commitments under article 1(1)c of the CCM, should install legislation that prohibits investments in cluster munition producers.

The ICBL-CMC will continue its work towards a world free of cluster munitions, and will continue its role in monitoring use, production and country profiles, as well as the universalization and full implementation of the Convention on Cluster Munitions; the international treaty banning these weapons.